lease to purchase

Housing for Long-Term Affordability

Since 1999, Common Wealth has purchased, rehabbed, and re-sold 34 properties to first-time lower-income home buyers in our Lease-Purchase program. Most of these homes have been two-unit properties, though some were single-family homes.

The goal of the Lease-Purchase program is to provide affordable home ownership opportunities and one-on-one homeownership counseling. A resident in this program may rent a house for a period of time with an option to buy, as a portion of their rent payment is deposited into a down payment account.

Common Wealth provides deferred payment second mortgage financing which helps to reduce housing costs, and a shared appreciation agreement is created to help keep these Lease-Purchase Program houses affordable into the future for low to moderate-income households.

Lease to Purchase Program

The Lease-Purchase program provides an opportunity for first-time homebuyers to become homeowners and maintain long-term housing affordability through a shared appreciation model.

This program is designed to assist persons who could not otherwise afford to purchase a home without assistance.

How it Works

- A participant leases a house from Common Wealth with an option to purchase.

- A portion of their monthly rental payment is deposited into an account over a period, up to 3 years, to accrue a down payment of 3 to 5%.

- Other sources can be used for a down payment such as personal savings or a security deposit. Additional down payment assistance grants or loans may be available to help with down payment or closing cost assistance.

- Once the down payment is accrued, the participant can purchase the house from Common Wealth.

- A deferred payment second mortgage for approximately 25 to 35% of the value of the house will be used to help decrease the housing costs.

- A 50/50 shared appreciation model, which limits the amount of appreciation an owner will receive, will be used to keep this housing affordable into the future.

Qualifications

- A participant must have satisfactory credit rating and a stable employment history.

- A participant must qualify for a first-position mortgage with a lender who will have different qualifying criteria than Common Wealth Development.

- In order to qualify for this program, interested persons must also have an income at or below 80% of Dane County median income, adjusted for family size, at the initial time of occupancy.

- Dane County income limits (2024):

Household size | 1 person | 2 people | 3 people | 4 people | 5 people |

CMI % = 80% | $68,500 | $78,250 | $88,050 | $97,800 | $105,650 |

- The household must not own other property at the time of closing.

- Participants must be willing to participate in homeownership counseling which could consist of monthly budget and credit building education as well as home maintenance skills.

- This opportunity does not require you to work with a Realtor to purchase a property. Please contact homes@cwd.org if you need assistance through the application process.

How to Apply

An interested person may apply using the application linked below. Applications must be completed in full to be considered. Please refer to the flyers below to see what supporting documents are necessary to verify the information provided in your application. Complete applications and supporting documents may be sent via email to homes@cwd.org or be turned in physically at our main office located at 1501 Williamson St. Madison, WI 53703. Completed applications will be reviewed on a first-come-first-serve basis.

* We are not reviewing applications at this time. Thank you for your interest!

For questions email homes@cwd.org

No Homes Available At This Time

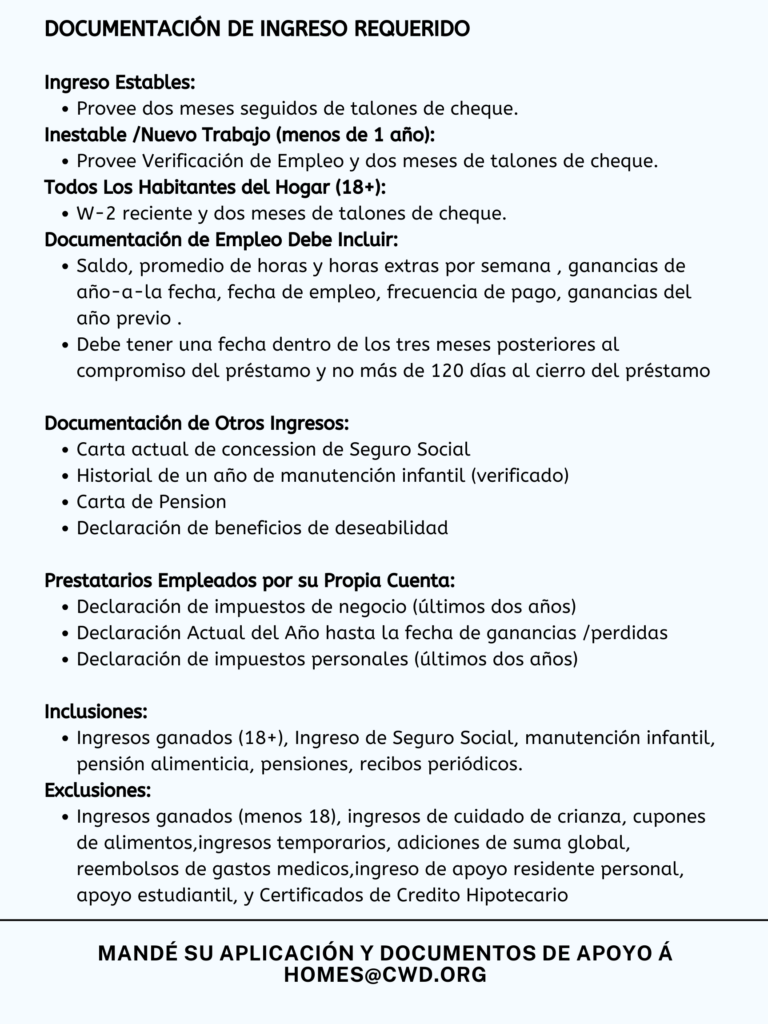

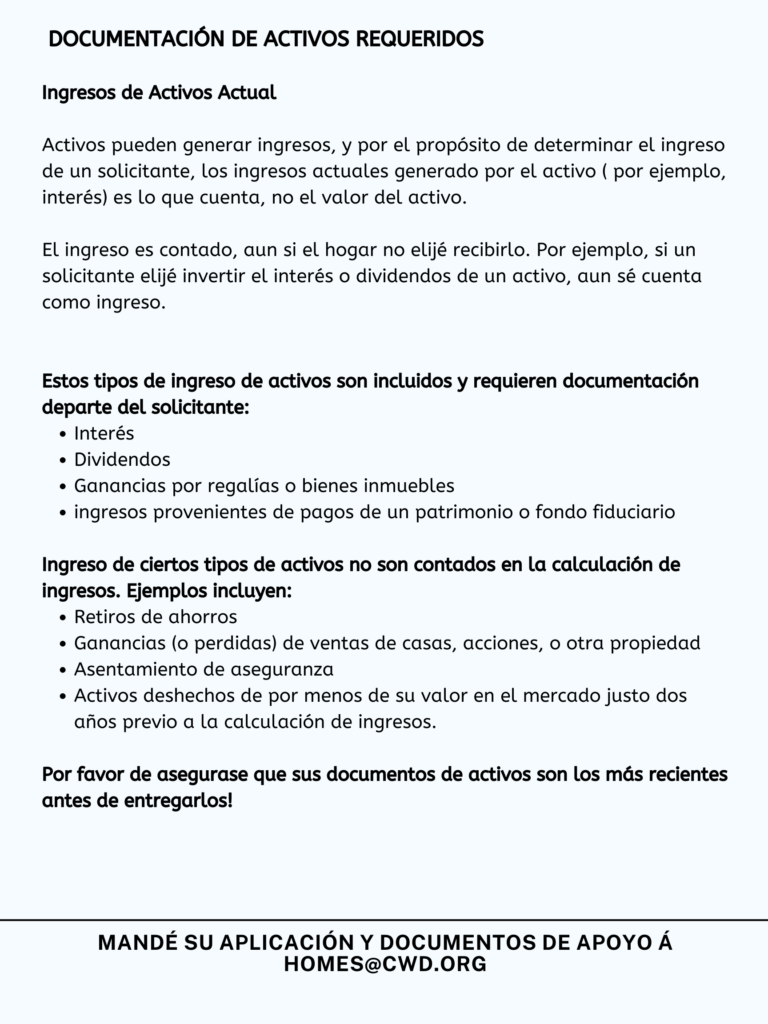

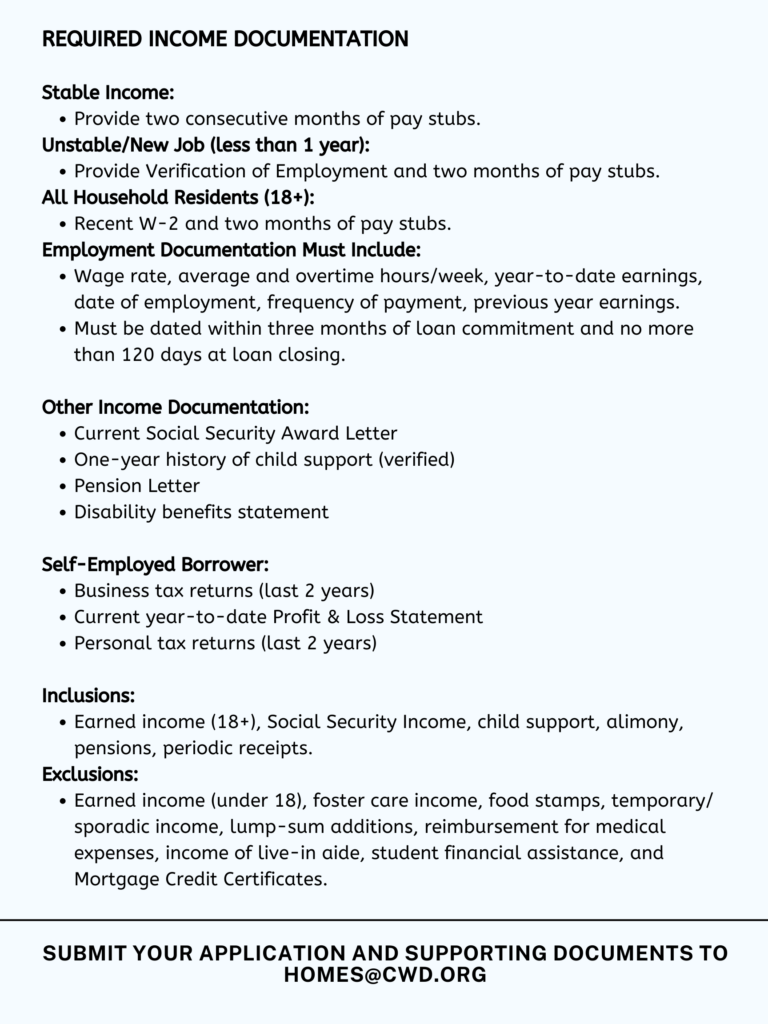

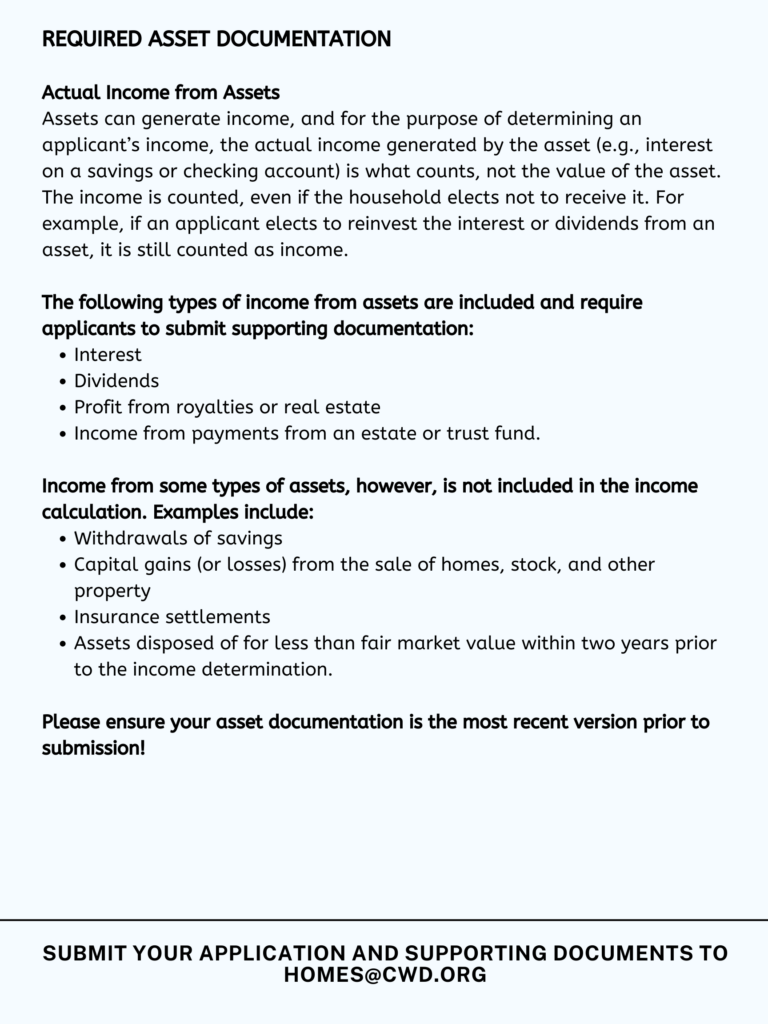

Required Supporting Documentation

Casas Disponibles Para Comprar

Documentos de Apoyo Requeridos